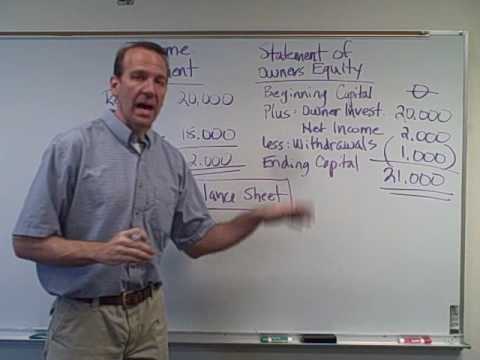

Let's continue on now with the financial statements. The textbook shows four financial statements, but at this time, I'm not going to go over the statement of cash flows (cash flow statement) because I think we need to learn that later in the semester. I don't think it's something that we need to understand right now, but it just shows the cash coming in and going out. I think the three most important financial statements right now that you need to be familiar with are the income statement, the statement of owner's equity, and then we're going to prepare a balance sheet. Now, we need to know the balances of these different accounts. The accounts, once again, are such things as cash, accounts receivable, accounts payable, your capital account, withdrawal account. We need to know the balances of all these accounts in order to prepare financial statements. Now, I'm just going to be using some numbers that I'm pulling out of my head to put some financial statements together, but on homework or in the textbook, you'll see where the numbers are coming from to plug into your different financial statements. So, now the first financial statement that you're going to want to prepare probably is the income statement. The income statement measures the profit of the business. That's really important. Think about it, if this was your business, wouldn't you want to know how much profit you're making on a monthly, quarterly, or annual basis? Well, if you're doing your books right, you'd be able to prepare an income statement in order to figure out how much profit you're making. The profit is the net income. So, let's just say that we look at all of our pizza sales, drinks, and other items we sell in our business, and...

Award-winning PDF software

Financial statement schedule a Form: What You Should Know

Failure to participate may result in contempt or a charge of contempt against you by the court. For the time being, if you are a Marine receiving medical or dental benefits, it is best to contact your commanding officer to determine if you are in the right jurisdiction. This is based on state law. A non-citizen is not required to pay income taxes. If the Marine is required to pay income taxes, pay the income taxes and send the appropriate receipts. If he/she is not required to pay income taxes, then the Marine should not receive pay if he/she is charged with contempt (this could still occur, even if your rights were restored). If the Marine is being charged with a crime, the legal costs of the case are paid by the federal government. All expenses must be paid, not by the Marine but rather by the federal government. The U.S. government is paying for all the legal expenses of the case. No federal tax is being paid to the Marine on that date. If your Marine has been released from jail and is being charged with a crime, and he/she has already had the charges withdrawn, the Marines will have to pay for his/her transportation to court, and then he will have to pay for the court appearance on this date. If the Marine is charged with contempt and sent to jail, he/she is not required to pay for the transportation since the Marine would be required to give up his/her pay if convicted of contempt. Note. The Marine can avoid the legal fees incurred by a court appearance by submitting all necessary paperwork and paying the entire amount of the fees in advance through the Court-Martial. If you fail to submit all necessary paperwork and pay in advance, then you may have to pay all the fees for the appeal of this legal matter, not only the costs for an appearance in court. You may also like to check out the following links: The military does not pay for you to visit the vet for your annual physical exam. This includes a hearing, a physical exam, an appointment, and medications as well. They will cover the cost of your travel there and back. You are expected to report any health related issues immediately to your commander. Your chain of command needs to know as quickly as possible. You are not required to go to the vet for these things. Check out to get your free consultation with an expert at the moment.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Long Financial Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Long Financial Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Long Financial Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Long Financial Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Financial statement schedule a